The post-pandemic period has allowed us to keep the utmost mental and physical well-being. Not only have we become more synchronized than ever but we also prioritized several aspects of life as compared to older times. However, there are specific factors that can determine your healthcare and well-being. These are the steps, approaches, and measures you take to safeguard your health. And, when it comes to such a subject, what do you often refer to? Is it heart health, muscle generation, or virus-free attributes of the body? Even though you have monitored all these, the most important thing you are missing out on is vision.

What do you do to secure your eyes? Do we have some sort of insurance for such a body organ? Yes, there is. The term vision insurance is utilized to describe and demonstrate wellness and health plans crafted to alleviate your costs for standard preventive eye exams and prescription contact lenses and eyeglasses. Moreover, some vision plans can also offer specific discounts and deals on elective vision corrective operations like PRK and LASIK.

However, unlike significant insurance policies that can offer unlimited advantages after specific deductibles and copays are met, maximum vision insurance plans are wellness benefits and discount plans that can provide discounts and benefits for annual premiums. In effect, such wellness benefits and vision discount plans can also offer savings like gift cards. As such, you can use them to cover the totality of your essential eyewear cost. Furthermore, you can also use them to make premium eyewear enhancements and products like anti-reflective coating, progressive lenses, and photochromic lenses.

So, when you decide to purchase vision insurance, ensure to fully understand the benefits and costs associated with the plans you have selected. Besides, if you already have vision care coverage through work insurance plans, know that vision insurance plans typically operate differently than various other health insurance programs and plans or immediate medical plans.

Where Can You Get Vision Insurance?

One can acquire group vision insurance through your association, company, school district, and many other avenues. You can also look for several other government programs such as Medicaid or Medicare. However, suppose you do not pass the eligibility test for group plans because of your self-employment or other reasons. In that case, there are many vision insurance providers out there who can offer individual policies for you to purchase.

Moreover, vision insurance is one of the insurances that can add a valuable benefit linked to your indemnity health insurance plan, preferred provider organizations (PPOs), and health maintenance organizations (HMOs) that have a contract with several managed vision care networks. If you did not know, indemnity health insurance is traditional health insurance that can allow policyholders access to healthcare providers of their choice.

Meanwhile, an HMO is another group of providers like laboratories, doctors, hospitals to offer health care to members at discounted or lower rates. Typically, these plan members are needed to access health care, comprising vision care, only through the HMO providers. Furthermore, a PPO network is a group of providers organized to offer healthcare solutions and services to plan members at fixed costs below retail prices

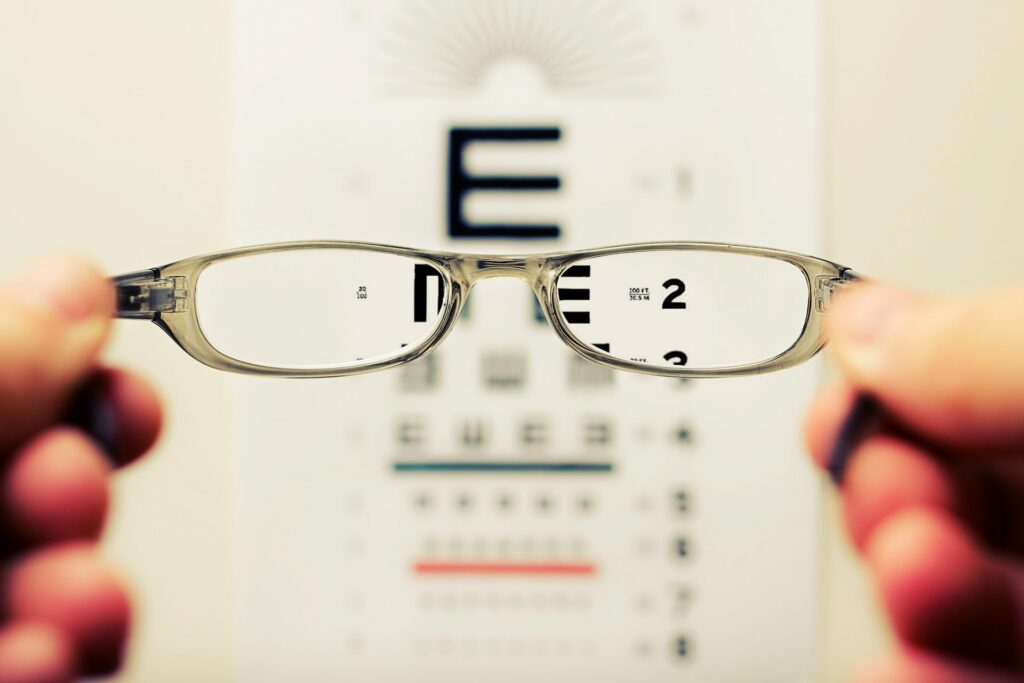

Image Credits

So, when you purchase vision insurance, you get the following advantages:

- Access to several providers, comprising ophthalmologists and optometrists, optical laboratories, eyewear stores, and LASIK surgeons.

- Preventive, routine eye care solutions at reduced costs

What types of vision insurance programs/plans are available?

Specific vision insurance typically arrives in either vision-based packages or discounted vision plans. Usually, one of the vision benefits packages offers free eye care services and eyewear amid fixed dollar amounts in exchange for annual membership fees or premiums and a small copay every time you get the service or have access to them.

A discount plan, meanwhile, can provide eyewear and eye care at low and discounted costs after paying an annual premium or membership cost. However, in some cases, these benefits programs or discounted vision plans can be deductible – a stagnant dollar amount you should pay your eye care provider before any benefit takes effect.

Both these vision insurances can be custom-developed and designed to meet the needs of a broad range of clients, comprising unions, school districts, and small and big companies. These plans generally provide discounts and cover the following services and products:

- Eyeglass frames

- Annual eye examinations

- Eyeglass lenses (including enhancements and lens coatings)

- Discounted rates for PRK and LASIK

- Contact lenses

What does vision insurance cost?

All the vision insurance prices vary, depending on how the plan is designed. Moreover, costs can also vary based on your residence. Taking a general example, the VSP, which is the largest program provider in the US, has several costs for individuals, compared with many other insurance types and forms. For this, you might have to check with several websites and other private vision insurance providers.

Featured Image Credits: Pixabay